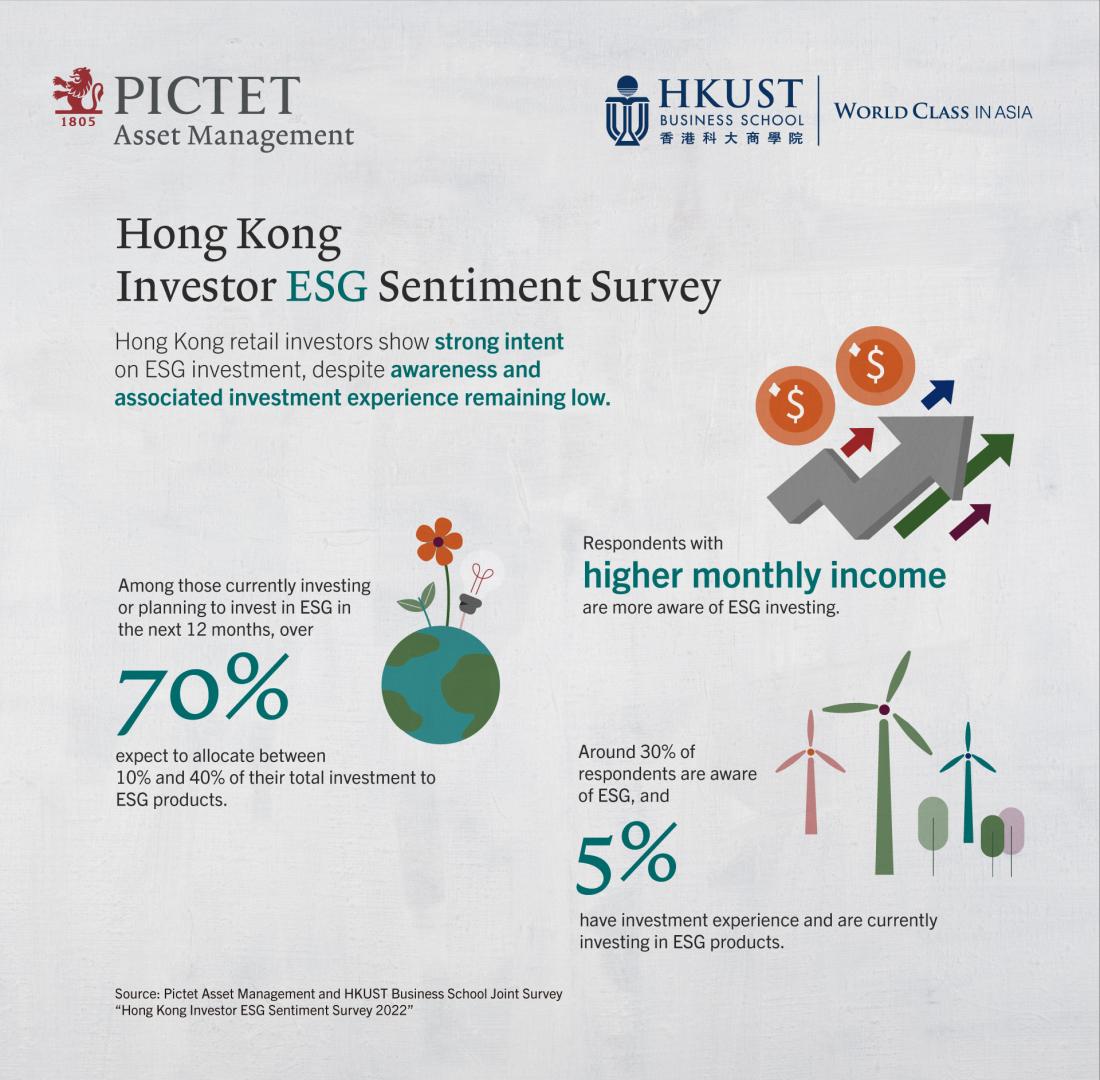

HKUST and Pictet Asset Management survey: Hong Kong retail investors show strong intent on ESG investment, despite awareness and associated investment experience remaining low

- In general, around 30% of respondents are aware of Environmental, Social, and Governance (ESG), and only 5% them have investment experience and are currently investing in ESG products.

- Respondents with higher monthly income are more aware of ESG investing.

- Among those currently investing or planning to invest in ESG in the next 12 months, over 70% expect to allocate between 10% and 40% of their total investment to ESG products.

To understand the views and perceptions of potential individual investors towards sustainable finance, Pictet Asset Management has initiated a large-scale survey in collaboration with the School of Business and Management of The Hong Kong University of Science and Technology (HKUST Business School). Pictet Asset Management and the HKUST held a virtual media briefing today to present key findings and insights from the survey. The survey found that while the awareness and experience of Hong Kong individual investors in ESG investing remains relatively low, they express keen interest in ESG investment if they have better product knowledge and understanding. It signals strong growth potential in ESG investing and green finance in the near future and the need to strengthen investor education. The survey results came a day before the Hong Kong government opens the first-ever retail green bond subscription.

Conducted online between 30 December 2021 and 20 January 2022, the survey collected a total of 3,770 responses across different social demographic sectors. It examines a wide range of topics among Hong Kong retail investors, including their awareness and practice of ESG investments, key considerations in investment decision-making, and ESG elements they focus on.

Professor Christine LOH, Chief Development Strategist, Institute for the Environment at HKUST, addressing a media briefing, said “As governments, regulators and companies are increasingly focused on sustainable development, the value of ESG-themed investment is aggressively taking shape globally. Governments around the world are beginning to regulate what companies need to disclose because governments are adopting new policies that related to climate change, and social improvements. In order to succeed in their climate policies, governments need private sector investments to be directed towards green projects, and socially responsible projects. This survey shows that more investor education is needed to turn ESG awareness into action, and the investment industry plays an important role.”

ESG awareness and investment experience still low but shows strong investor intent and high growth potential

Awareness of ESG is still low with only around 30% saying they have heard of “ESG investing” or know what ESG stands for.

Respondents with higher monthly income are more aware of ESG. 47.8% of those with HK$70,000 and above in monthly income being aware of ESG investing, compared with 28.2% of those with monthly income below HK$70,000.

There appears to be a gap between awareness and action, while some respondents are aware of ESG with investment experience, only 5% are currently investing in ESG products. However there is strong investor intent, as among those currently not investing in ESG products, more than half (54.8%) are planning to invest in ESG products within the next 12 months.

Among the potential ESG investors, the majority 74.4% of them expect to allocate between 10 to 40% of their total investments to ESG products.

Recognizing ESG as the trend with long-term benefits

Top three reasons selected by respondents who are currently investing in ESG products or planning to invest in ESG products within the next 12 months are:

- “ESG is the trend to come and I want to capture the opportunities.”

- “ESG investment brings long term benefits to the company, environment and society”

- “The focuses of ESG products align with my personal values”

Product knowledge is key driver in considering ESG investment

The top three considerations of surveyed investors when making an investment decision are:

- Investment risks (80.8%)

- Understanding the product (79.8%)

- Past performance of the product (67.3%)

With product knowledge being a key influencing factor, more than 70% of investors who have not heard of ESG investing, would actively consider investing in ESG products if they know the investment products with ESG ratings can contribute to sustainable development and bring positive environment and social impact, and at the same time people are paying more attention to ESG globally.

Age is a significant factor, where the younger generation is more willing to actively consider investing in ESG products in this case.

Even for those who have no plans to invest in ESG products within the next 12 months, the majority (75.1%) indicated that they would be more willing to invest in or pay attention to ESG products if ESG products have long term positive impacts.

Presenting key findings from the survey, Professor TAM Kar-Yan, Dean of HKUST Business School, commented that “ESG is currently not a familiar concept among the Hong Kong population with only a very small fraction currently investing in ESG products. Given the importance of ESG in shaping a better world and building a sustainable future, there is a strong need to increase the society’s awareness of ESG.” He added that there is good potential for younger people to invest in ESG products, but more education will be needed on benefits of sustainable finance to society and the global community in order to get them on board with ESG investing.

Freeman TSANG, Head of Intermediaries, Asia ex Japan at Pictet Asset Management, said: “With the rising interest in ESG investing among Hong Kong investors, we see the gross sales of our 9 ESG thematic funds increased 1.5 times in three years at March 2022. Globally, strong demand is shifting from institutional to private banks and retail investors. Among these 9 thematic equity strategies all classified as Article 9 [1] under SFDR, Hong Kong investors show highest interests in themes on global environmental opportunities and clean energy. Looking ahead we expect themes related to the ‘Social’ aspect in ESG to gain more attention, such as those investing in smart city and the future of food.”

“Our thematic equity strategies identify economic activities underpinned by long-term growth trends. The 3-year performance of strategies such as clean energy, global environmental opportunities and timber exceeds the equity market benchmark, debunking the common misconception that ESG products will generate lower returns,” Freeman added.

As an industry pioneer with over 27 years of experience in thematic equity investing, Pictet AM has a total of 15 thematic equity strategies globally, with USD 76 billion in assets under management at 31 March, 2022.

Download Hi-Res Images and Event Materials:

About the Pictet Group & Pictet Asset Management

The Pictet Group is a partnership of owner-managers, with principles of succession and transmission of ownership that have remained unchanged since foundation in 1805. It offers only wealth management, asset management, alternative investments and related asset services. The Group does not engage in investment banking, nor does it extend commercial loans. With USD 767 billion in assets under management or custody at 31 December 2021, Pictet is today one of the leading Europe-based independent wealth and asset managers.

Headquartered in Geneva, Switzerland and founded there, Pictet today employs over 5,000 people, with 30 offices globally.

Pictet Asset Management includes all the operating subsidiaries and divisions of the Pictet group that carry out institutional asset management and fund management. At 31 December 2021, Pictet Asset Management managed USD284 billion in assets. Pictet Asset Management has eighteen business development centres worldwide, extending from London, Brussels, Geneva, Frankfurt, Amsterdam, Luxembourg, Madrid, Milan, Paris and Zurich to Hong Kong, Taipei, Osaka, Tokyo, Singapore, Shanghai, Montreal and New York.

For more details about ESG investment, please visit website: https://bit.ly/3L6inPj

About HKUST Business School

The HKUST Business School is young, innovative and committed to advancing global business knowledge. The School has forged an international reputation for world class education programs and research performance, and has received many top global rankings. For more details about the School, please visit //bm.hkust.edu.hk/.